WSJ: The decline of the WTI benchmark

China's thirst for water grows

Russian Central Bank may pause after surprise rate increase. Inflation, inflation everywhere.

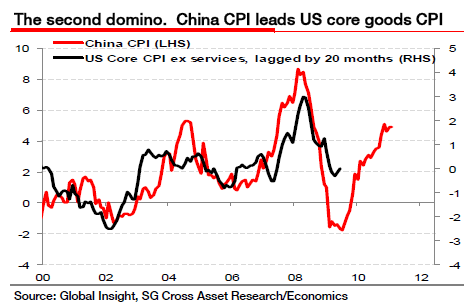

Goldman on Chinese PMI numbers vs. The China Domino has fallen!, China Lending-Binge Hangover Looms as Wen Spurs Construction

Beijing’s Bad Debt Bailout: Problem Solved?. And with that next bailout, Michael Pettis, Andy Xie, and Victor Shih go into my "A" book of quality economic/market thinkers.

Do or die for China premier Wen Jiabao. This will probably be important in sometime next year.

China takes on its massive muni mess with a $463bn bailout, Financial Shock and Awe in China. 10% GDP, translated to US GDP, is about $1.4 trillion. But why allow local government issue bonds?

‘Real’ US Treasury yields go back to zero

The great gilt mystery

Is bond trading dying?. I blame Mannwich.

The Taylor Rule recommends raising rates to 1%

The stocks-housing disconnect

Hunger for foreign tech stocks overrides risk and Is the cryptocurrency Bitcoin a good idea? and Meet the guy that cost John Paulson $500 million

Gov. Rick Scott, Solantic and conflict of interest: What's the deal?. Only in Florida!

Great link fest as always, Emmy. Can't wait to start reading.

ReplyDeleteManny,

ReplyDeleteYour last ZH link from yesterday really does tell the truth about labor.

Notice the acceleration in the Bush years when the big lie that tax cuts and less regulation creates jobs was being promoted as the cure to all of our problems including athlete's foot and toe nail fungus.

That free markets and unfettered capitalism create jobs.

ReplyDeleteIt was and still is all a big lie to brainwash the sheeple into voting for people who think that tax cuts for billionaires, millionaires and corporations are the way to prosperity.

Why is this important on a trading blog? Personally, it is useful to see that unemployment is getting worse, not better which has long lasting effects on the economy, and all the lies and birth and death adjustments cannot obscure the real rate of decline in employment.

Without the consumer, our economy is dead in the water.

ReplyDeleteEmmanuel,

ReplyDeleteThanks for the links.

I really hope this Ems story doesn't turn out like U.S. subprime mess.

From the link," Meet the guy who cost John Paulson 500 million":

Look at other Chinese ADRs that sold off:

Orient Paper fell 50%

Rino International fell 60%

China MediaExporters fell 28%(stock had to halted and CFO resigned).

Duoyuan Global Water fell 40%(CFO resigned).

Migao.to fell some.

I wonder how much Chinese and other Ems ADRs lost in total due to this story.

ICan

Another really good article to read is,"Beijing's bad debt bailout:problem solve?".

ReplyDeleteAnd China's water woes. Someday China will fight India over water. Lot of Indian water in the north comes from himalyan rivers originating from Tibet.

ICan

"Someday China will fight India over water. Lot of Indian water in the north comes from himalyan rivers originating from Tibet."

ReplyDeleteI wish I could bet real money on that.

Woohoo Emmie - So much China I don't know what to do with myself! :-)

ReplyDeleteICan - I agree!!

@Emmanuel(10:42)

ReplyDeleteAccording to Doug Kass -his 10/12 predictions for the year - one of them is about India/China war over water. I wouldn't say that fast.

ICan

Interesting take from Steve Keen on a double dip.(Scroll down to May 25 video.)

ReplyDeletehttp://www.debtdeflation.com/blogs/

mike

@Emmanuel117:

ReplyDeleteGreat reading. Read 'em all.

One more detail, Obama's a liar. He said that GM has paid back their loan.

They have not.

"I didn't run for president to get into the Auto business. I've got more'n enough to do. I ran for President because too many Americans felt their dreams slipping away from them...So I placed my bet on you, my faith in the American worker. And I'll tell you what, I'm going to do that every day of the week because what you've done vindicates my faith. Today all three automakers are turning a profit. That hasn't happened since 2004. Today all three American auto manufacturers are gaining market share, that hasn't happened since 1995. And today, I'm proud to announce the government has been completely repaid for the investments we made under my watch".

A lie. A blatant lie.

You and I, the taxpayers, still own 60.8% of the equity of GM stock. This has not been paid back.

We gave GM 49.5 Billion. GM has not paid back 49.5 Billion. The pure cash loan we gave GM was 6.7 Billion. That 6.7 Billion has been paid back, using a 13.4 Billion "working capital" escrow fund created by the government and given to GM.

If any statement by an elected official was such a blatant lie goes un-censured, well, I guess we need to give back Bill Clinton's censure for not having sex with, um, that woman.

I'm ready to retire. Even if I don't receive my pension. I don't think I care to be a part of this lie anymore.

I walked out of a company when the CEO told me to get the work done in India; that no new work would be done in the US. (sorry, ICan). I guess it's time for me to walk out of this deal too.

Rock,

ReplyDeleteThe entire Bush-Cheney administration was a lie, how did we know they were lying? Their lips were moving.

Their lies cost us trillions of dollars, continue to cost us billions every month in Iraq and Afghanistan, and cost 4,683 people their lives, 32,000 wounded in combat operation many with horrific injuries.

And you are ready to pack it all in because of a supposed lie from Obama about whether GM paid back a loan?

Really? This is what is pushing you over the edge?

busy busy weekend! Finally some beautiful weather for a change! :)

ReplyDeleteHah, good argument I just heard on the news. If businesses in this country are "taxed too much" then why are they sitting on trillions in cash???

ReplyDeleteThor,

ReplyDeleteBecause they needed it to create all of those jobs we don't have. They can create jobs that doesn't mean they actually hire someone for that job.

LOL emmy. I'll take the blame for that. No problem. Very good! Got a good laugh (and double take) out of me when scanning your links today. Back later. Been outdoors all weekend but got one last outing in me for dinner on Lake Minnetonka. Gotta get it while the gettin's good here in the summer.

ReplyDeleteThat stocks-housing disonnect article is interesting, but might it just be that some people made a shit load of money off of the Fed and stupdity-induced dot.com bubble and subsequent bust, and then neeeded somewhere to put it, so they put it in housing to spur that Fed and stupditiy-induced bubble and bust. Now that money is sloshing back into the stock market gain. The zig-zag bubble economy. Back and forth it goes. Back to housing next after this one crashses again? Or something else? Tulips? Guillotines? Pitchforks?

ReplyDelete@Denise: Isn't it amazing that so many people continue to disbelieve the facts? I find it both horrifying and fascinating all at once. It really is a head-scratcher. Are people really THIS brainwashed and collectively insane or living in a fact-free fantasy world? Is the denial and delusion really this strong? It's really fascinating, as I mentioned. When will that "oh shit" moment hit the Sheeple at large? Or will that ever really happen?

ReplyDeleteThe lies that pour out of the Heritage Foundation, The Cato Institute and American's For Tax Reform are staggering.

ReplyDeleteTax cuts for the wealthy and corporations create jobs.

Minimum wage hikes destroys jobs.

Corporations in the US are over taxed and this is a job killer.

Corporations in the US are over regulated and this is a job killer.

Etc. Rinse and Repeat.

And they are never challenged on these "statements", the MSM just accepts them as true and they become the new standard.

@Rock,

ReplyDeleteYour 11:25,

You've got ethics! And for that, you have my respect, Sir!

ICan

Further on Sino-Forest:

ReplyDeleteOne director is Simon Murray- Chairman of GLENCORE!

HongKong based Simon Murray, also manages Hutchison Whampoa for billionaire Li Ka Shing.

The Globe and Mail has been updating the story all weekend and the disabled comments.

Reuters's Felix Salmon, http://blogs.reuters.com/felix-salmon

Ican